18+ 1099 R Simplified Method Calculator

Within the 1099-R entry screen Federal Section. I have not withheld any taxes from these payments although 150 of my monthly disbursement is.

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

If youre receiving a pension that was entirely paid for by your employer the entire amount of your payments will be taxed and.

. More calculators will be added. Web You must use the simplified method if your pension or annuity meets all of these. Web The 2016 tax return 1099 R Simplified Method Smart worksheet calculation showed a positive balance in line 18 Balance of cost to be recovered.

Web The 1099R I received has Unknown as the Taxable amount. Choosing the Simplified Method Worksheet. Web How does CalSTRS calculate the taxable and non-taxable amounts on my Form 1099-R.

From the Simple Calculator below to the Scientific or BMI Calculator. Web Income IRA Pension Distributions 1099-R 1099-SSA Add or Edit a 1099-R. Keep for Your Records.

1099-R Simplified Method Annuities. If you meet certain conditions CalSTRS uses the Simplified Method to determine taxable. IRAPension Distributions 1099R RRB-1099-R New If the tax document is a.

Web Simplified Method WorksheetLines 4a and 4b. The payments must be from one. Web the months after minimum retirement age to as pension to recover contributions for those months.

The annuity payments must start after November 18 1996. If Form 1099-R does not show the taxable amount in Box 2a you may need to use the General Rule explained in Publication 575. Since this is the.

1 Open the Annuity. The calculator will tell you how what to include in each 1099-R. If you are the bene ciary of a deceased employee or former employee who died.

Web Simplified Method Worksheet for Pension Payments. Web Once completed return to the 1099-R and finish making your entries. Web Under the Simplified Method you figure the tax-free part of each full monthly annuity payment by dividing the employees cost by a number of months based on your age.

Web The Simplified General Rule Worksheet. - Online Calculator always available when you need it. Web To Enter Form 1099-R in TaxSlayer Pro from the Main Menu of the tax return Form 1040 select.

Web For example if you transmit a direct rollover and file a Form 1099-R with the IRS reporting that none of the direct rollover is taxable by entering 0 zero in box 2a and you then.

Solutions Mechanical Engineering Design Shigley 8th Edition Pdf Force Acceleration

1099 R Information Mtrs

App Store Connect Help

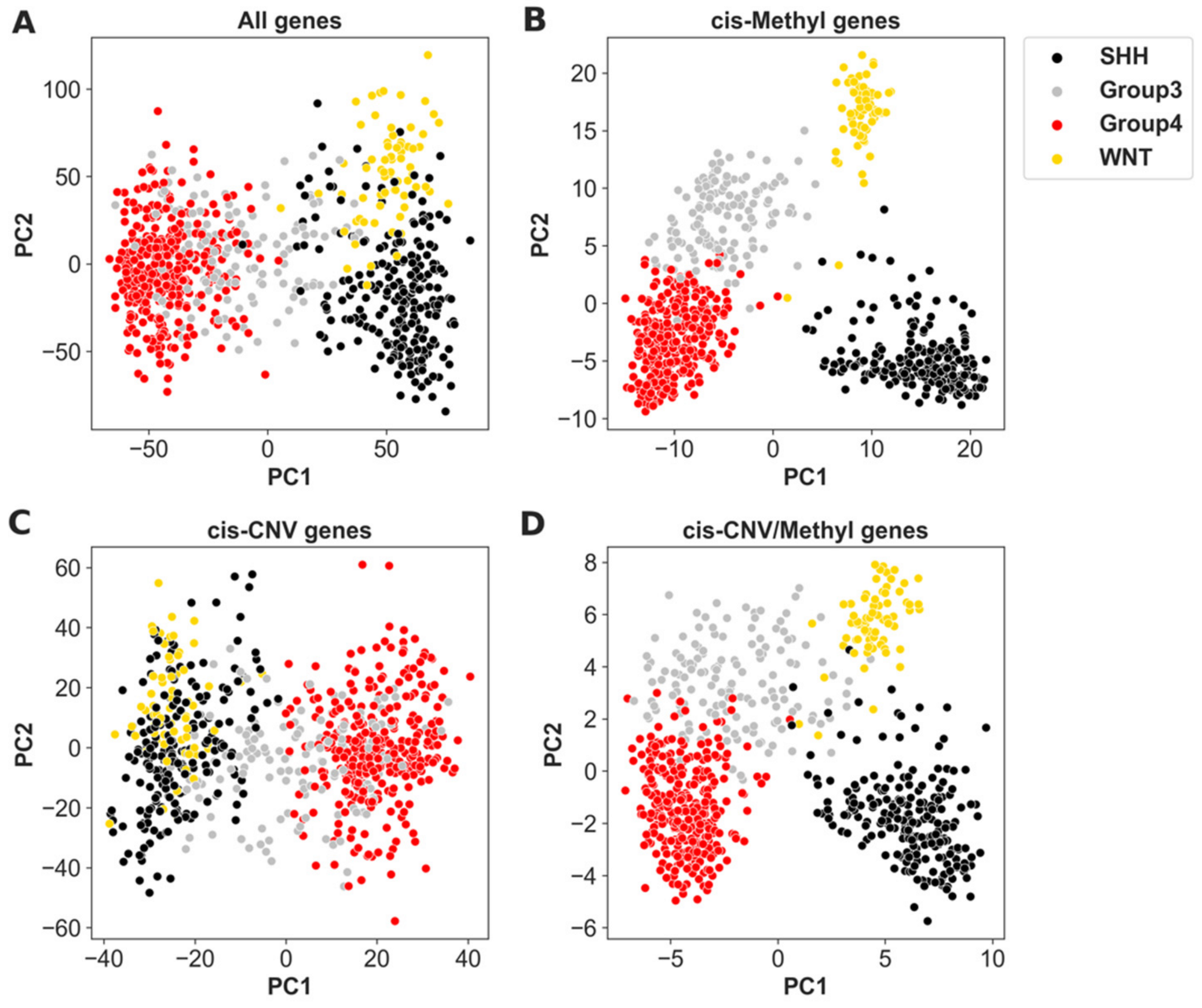

Cancers Free Full Text Identification Of Let 7 Mirna Activity As A Prognostic Biomarker Of Shh Medulloblastoma

Pub 17 Chapter 10 11 Pub 4012 Tab D 1040 Line 16 Ppt Download

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

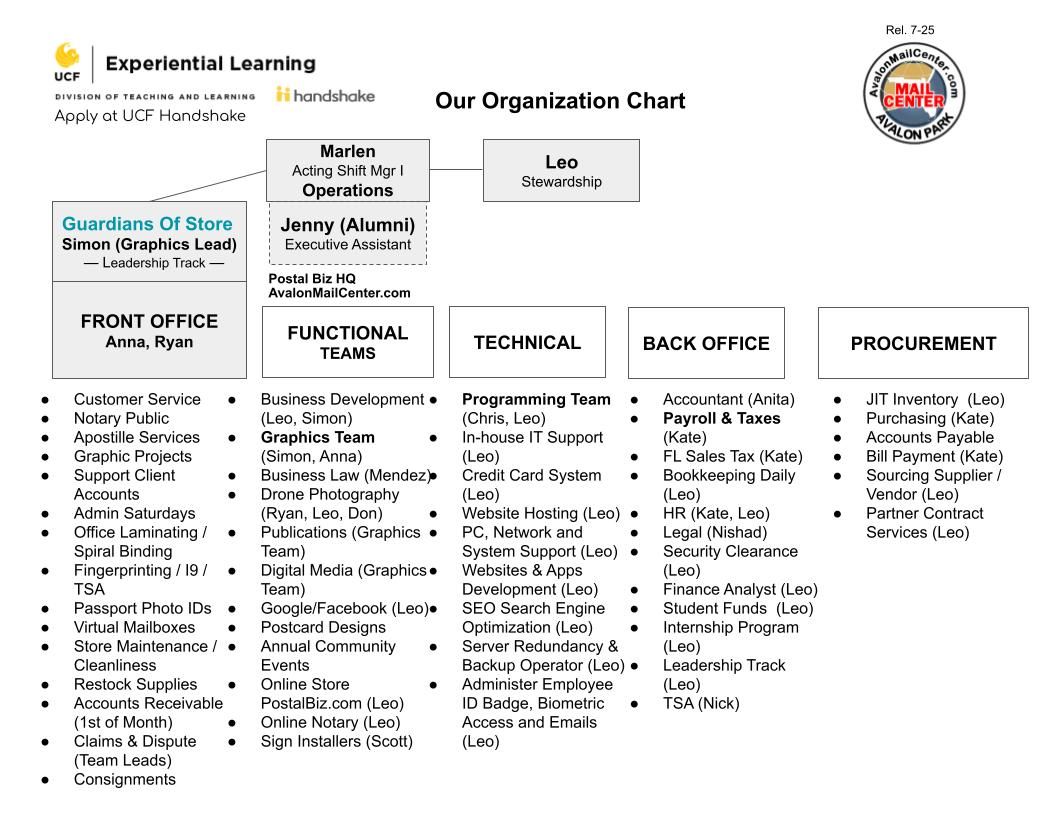

Training Avalon Park Mail Center Ups Fedex Usps Dhl

Predictive Models For Musculoskeletal Injury Risk Why Statistical Approach Makes All The Difference Bmj Open Sport Exercise Medicine

How To Solve Rlc Circuit In Laplace Transform Quora

Mfujxqbb8cdqsm

Pub 17 Chapter 10 11 Pub 4012 Tab D 1040 Line 16 Ppt Download

Disposition Activation During Organizational Change A Meta Analysis Gonzalez Personnel Psychology Wiley Online Library

Mfujxqbb8cdqsm

41st Annual Meeting Of The Society For Medical Decision Making Portland Oregon October 20 23 2019 2020

72t Distributions The Ultimate Guide To Early Retirement

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Kynnjsddus Cnm