48+ do mortgage lenders look at gross or net income

The 28 rule isnt universal. Browse Information at NerdWallet.

Mortgages With Net Profit Expert Mortgage Advisor

Get your free quote.

. Lock Your Rate Today. Apply Get Pre-Approved Today. Web To get approved youll need.

Web The 3545 Model. A FICO score of at least 580. Web For example if you earn 2000 per month and have a mortgage expense of 400 taxes of 200 and insurance expenses of 150 your debt-to-income ratio would.

Ad Compare the Best Home Loans for February 2023. Web Self Employed Mortgages If youre self employed sole trader or limited company we can help youMost lenders will take an average of the last 2 years trading. Get your free quote.

For example if your monthly pre-tax income. Its possible to find an FHA lender willing. Web This is the percentage of your gross monthly income that already goes toward debt and is a value that lenders will look at when approving you for a mortgage.

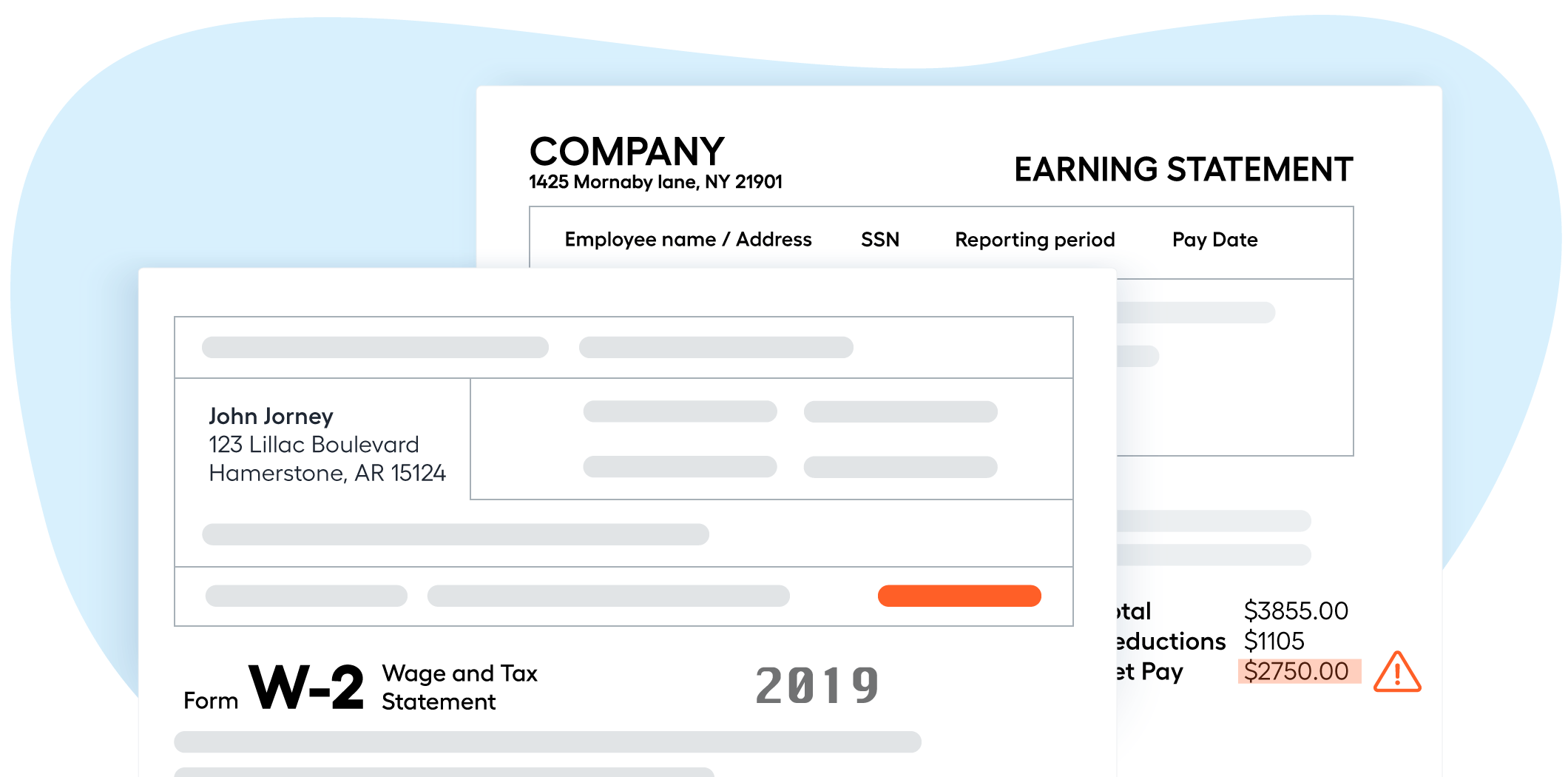

Web Gross income is really the most reliable number for most folks. Your and your employer are required by law to report an accurate gross income figure annually. A debt-to-income ratio below 50 percent.

This means that ideally you spend no more than 28 percent of your gross. Web A good rule of thumb is that income not shown on tax returns or not yet claimed will likely not be considered in your mortgage qualification calculations. Everyone is qualified using the very same.

Ad Being self-employed shouldnt mean you cant get a mortgage loan. Known as AGI adjusted gross income is also. A 35 down payment.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Principal interest taxes and insurance. Web Mortgage lenders take a deep look at applicants adjusted gross incomes when making lending decisions.

Flex loans offer greater flexibility when looking for a home loan. Web What income is considered when applying for a mortgage. This rule says you.

Some have two part-time jobs a full-time job and a. First its a universal application. To calculate income for a selfemployed borrower mortgage lenders will typically add the adjusted gross income as shown on.

Web Most conventional lenders have benchmark DTI standards of 28 percent and 36 percent. Web But there are a few good reasons why lenders use the gross amount instead of net pay. Ad Learn More About Mortgage Preapproval.

Ad Being self-employed shouldnt mean you cant get a mortgage loan. Use NerdWallet Reviews To Research Lenders. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

Take Advantage And Lock In A Great Rate. Home buyers often have multiple income streams. Flex loans offer greater flexibility when looking for a home loan.

Get Instantly Matched With Your Ideal Mortgage Lender. Some financial experts recommend other percentage models like the 3545 model. Web Asked by.

Percentage Of Income For Mortgage Payments Quicken Loans

Mortgage Income Verification Requirements Credit Check Haysto

Sec Filing Biontech

Presentation Htm

Per Loan Mortgage Profits Hit Record High In Q3 2020 National Mortgage News

Presentation Htm

How Do Mortgage Lenders Decide How Much You Can Borrow Mortgage Introducer

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

6 Critical Customer Support Metrics In Saas Benchmarks

Mortgage How Much Can You Borrow Wells Fargo

Do Mortgage Lenders Use Gross Or Net Income For Self Employed Steven Crews My Mortgage Broker Calgary

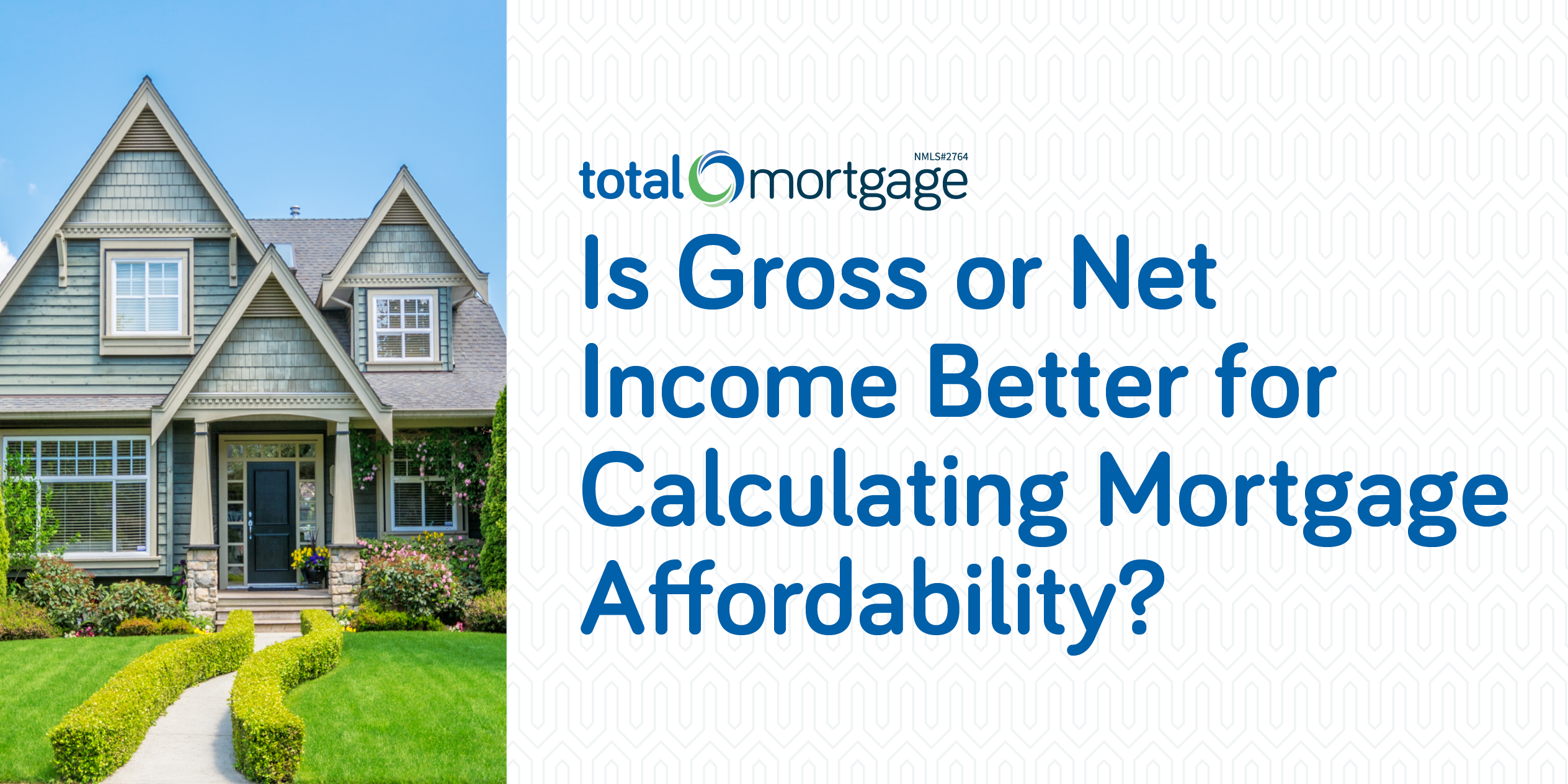

Is Gross Or Net Income Better For Calculating Mortgage Affordability Total Mortgage

Is Gross Or Net Income Better For Calculating Mortgage Affordability Total Mortgage

Mortgage Income Verification Workfusion Use Case Navigator

Presentation Htm

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Mortgages With Net Profit Expert Mortgage Advisor